European

IBAN-Name Check

One connection, global reach

Instant Payments, PSD3 and internationalisation of fraud require a pan-European solution. Schedule a meeting now for more information.

Leading in the fight against payment fraud

Payments around the world have increasingly shifted to digital channels. This has led to a sharp rise in fraud cases and Authorised Push Payment fraud – where fraudsters trick individuals and businesses into depositing money into the wrong accounts.

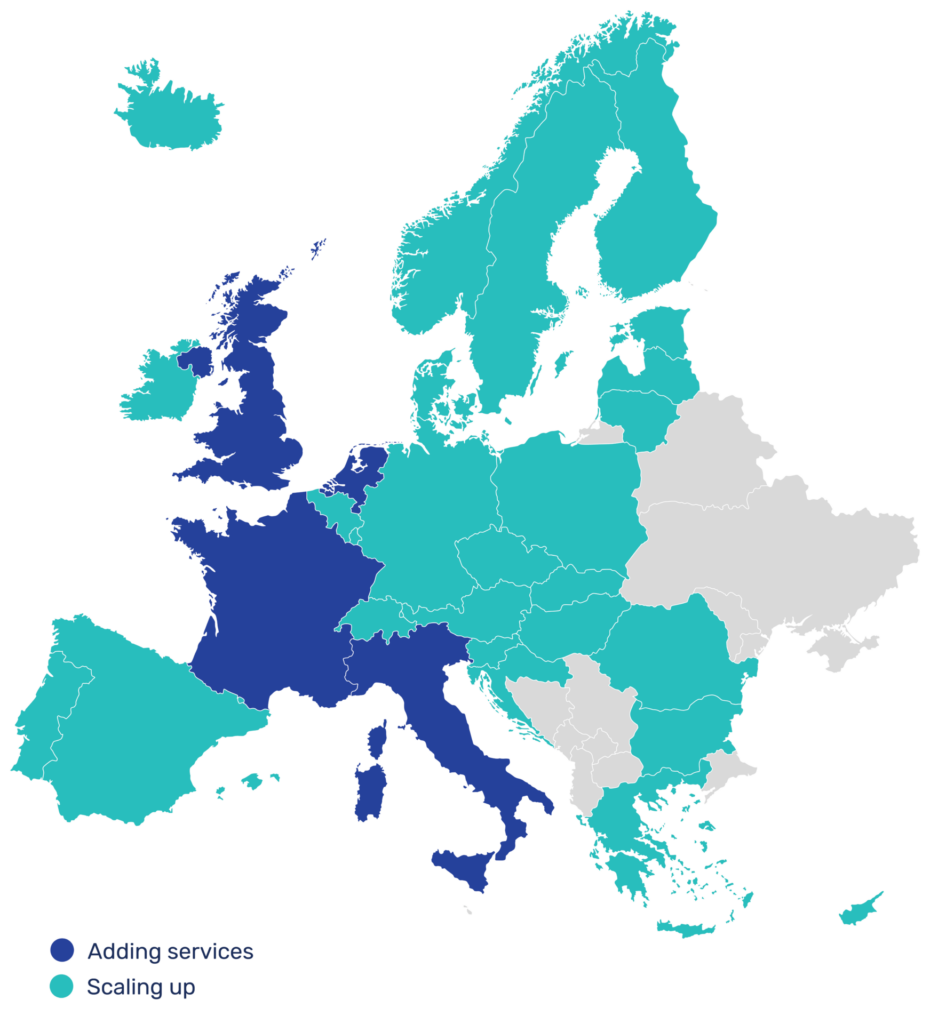

The IBAN-Name Check, has been live since 2017 and is available in several European countries. More than 100 banks are connected to SurePay directly, or through existing schemes. Both Domestic and Cross Border payments are thus checked. So far, we have already performed more than 7 Billion checks.

Batch Checks

Checking payment orders delivered in bulk is one of the new key requirements of the regulation. SurePay has multiple solutions available to suit your needs and meet the requirements to comply with the regulation.

Our batch check solutions are flexible, secure and fast.

European Checks for our portal customers

Besides the Dutch IBAN-Name Check, we also offer European checks for France and Italy. We do this as an add-on, on top of your portal package.

The European add-on enables the following European checks:

France:

- IBAN-Name Check

- IBAN Company ID match (Siren/Siret/BTW-nummer)

Italy

- Organisations, IBAN Company ID Match (VAT number)

We offer 80% coverage in France and 70% coverage in Italy. Many customers already experience through our portal, the benefits of the unique IBAN checks SurePay offers in these countries.