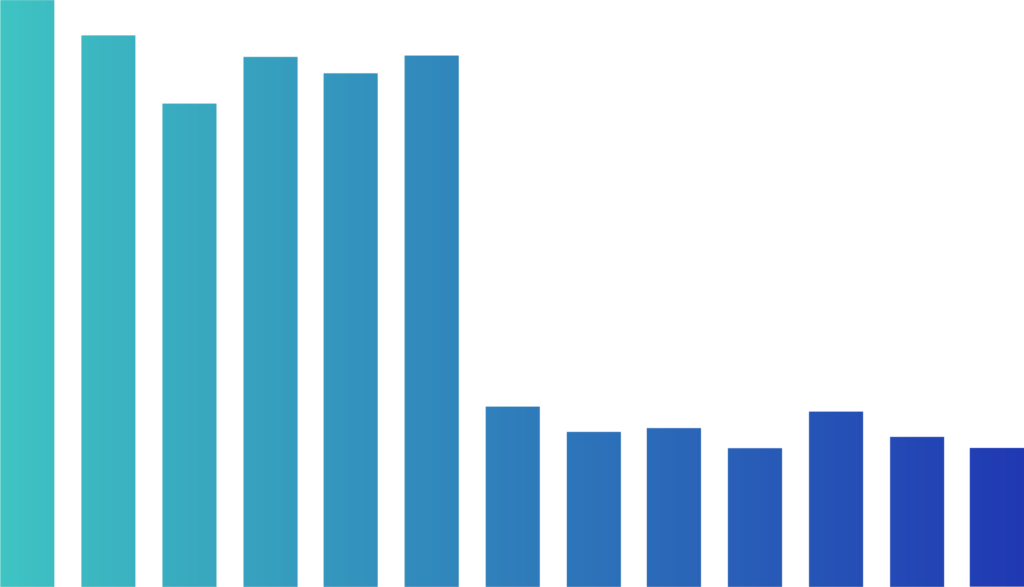

IBAN-Naam Check

voor jouw organisatie

voor banken

voor gemeentes

voor boekhouders

voor verzekeraars

voor pensioenfondsen

voor woningcorporaties

voor energieleveranciers

voor recherchebureaus

voor HR dienstverleners

voor semi-overheid

voor corporates

voor banken

Voor telecomproviders

Alle betalingen controleer je direct online of via je eigen

financiële systeem. Zo maak je jouw bedrijfsprocessen in

één keer veiliger én eenvoudiger.

Minimaliseer uitval bij de onboarding

Voorkom fraude, foutieve betalingen en verkeerde incasso’s

Altijd de juiste betaalgegevens van

je klant

Voldoe aan AML- & Audit eisen

Onze producten

Check direct via Exact

Koppel met Exact Online om betalingen binnen 2 klikken te controleren.

Checks in de EU

UK Confirmation of Payee

Onze Confirmation of Payee oplossing voor PSPs in het Verenigd Koninkrijk.

De laatste ontwikkelingen

SurePay IBAN-Naam Check portal nu beschikbaar in de Exact App Store

SurePay kondigt één Europese IBAN-Naam Check aan

CEO-fraude loopt op, maar kan worden geminimaliseerd met een IBAN-Naam Check

Met een IBAN-Naam Check voldoe je aan de WAS en voorkom je fraude bij uitbetaling salaris

Iedereen kan vanaf nu fraude en verkeerde betalingen voorkomen met de IBAN-Naam Check portal

Europese Commissie heeft aangekondigd dat een IBAN-Naam Check oplossing europa wijd wordt uitgerold

Hoe a.s.r. onze

IBAN-Naam Check

gebruikt

Voor welke processen?

Soepel onboardingproces

Voorkom uitval tijdens de onboarding van nieuwe klanten

en verhoog je conversie.

Voorkomen van fraude en fouten

Weet zeker dat het rekeningnummer hoort bij de opgegeven naam en voorkom verkeerde betalingen en fraude.

Boekhouding up to date houden

Valideer en controleer de gegevens van je klant, medewerker

en leverancier. Pas (eventuele) nieuwe gegevens direct aan

in je administratie.

Fraude en fouten onderzoek

Onderzoek of er in het verleden sprake is geweest van fraude en voorkom hiermee fraude en fouten in de toekomst.

We zijn op een missie om iedere bank, organisatie en hun klanten te beschermen tegen de groeiende dreiging van wereldwijde betalingsfraude

– David-Jan Janse, CEO SurePay

Wat onze klanten zeggen

Veelgestelde

vragen

De IBAN-Naam Check service is beschikbaar via een API en levert daardoor een real-time respons. Deze API kan je in praktisch al je bedrijfsprocessen inbouwen. Denk aan je CRM of facturatie software. Wil je meer informatie over hoe de API in jouw voordeel kan werken? Neem dan een kijkje op deze pagina

Databeveiliging is onze hoogste prioriteit. SurePay heeft de IBAN-Naam Check ontwikkeld in samenwerking met een groot aantal financiële instellingen, met als belangrijkste principe “Security by Design”. Alle diensten zijn gebouwd op bewezen veilige architectuur en onderworpen aan strenge controles voordat ze in productie zijn genomen. SurePay is compliant aan ISO 27001 en wordt periodiek gecontroleerd op databeveiliging. Daarnaast wordt bij SurePay B.V. jaarlijks een ISAE 3402 type II audit uitgevoerd met betrekking tot een Information Security Management System conform het ISO/IEC 27001:2013 raamwerk. Een geslaagde audit heeft aangetoond dat we voldoen aan alle punten van de norm voor informatie-beveiligingseisen.

Bestanden controleer je via de IBAN-Naan Check Portal. Met de Bestands Check doe je meerdere IBAN-Naam Checks in één keer. De Bestands Check functie is beschikbaar voor Business PRO-klanten en is te vinden in de bovenste menubalk. Klik op de knop “Bestands Check”, je wordt doorgestuurd naar een nieuwe pagina. Hier upload je een bestand. Een voorbeeldbestand is beschikbaar op deze pagina onder de optie “Bestand uploaden” en kan als referentie worden gebruikt. De eerste drie kolommen moeten worden ingevuld zoals aangegeven in het voorbeeldbestand, voordat het bestand wordt geüpload. Zodra de Check is voltooid, verschijnt de knop ‘Download Bestand’. Klik op deze knop om het gecontroleerde bestand te downloaden. In het bestand vind je vervolgens de matching resultaten.

Enkele Checks worden uitgevoerd op de hoofdpagina van de IBAN-Naam Check Portal. De gebruiker voert een naam en een IBAN in en klikt op de ‘Check’ knop. De resultaten van de check verschijnen vervolgens op dezelfde pagina.

Wanneer de gegevens kloppen is er sprake van een ‘Match’ en wordt er over het algemeen geen melding gegeven. Wanneer er geen sprake is van een match, maken we onderscheid tussen drie soorten meldingen:

Foutmelding

Is de naam die je intoetst helemaal anders dan de naam die bekend is bij de bank, bijvoorbeeld Pietersen in plaats van Jansen, let dan goed op. Er kan sprake zijn van fraude. Je krijgt een melding dat bij dit IBAN een andere naam bekend is bij de bank dan de naam die je intoetste. Neem contact op met degene aan wie je wilde betalen en controleer de betaalgegevens.

Typefout

Maak je een typefoutje in de naam, bijvoorbeeld Jansen in plaats van Janse, dan laten we de naam zien die bekend is bij de bank. Controleer zelf of de naam die wij voorstellen inderdaad de persoon of het bedrijf is die je bedoelt. Je kunt de voorgestelde naam overnemen.

Geen check

Wij kunnen de naam en het rekeningnummer die je ingeeft niet controleren omdat we geen toegang hebben tot de data. Dit kan bijvoorbeeld voorkomen bij een buitenlands bankrekeningnummer.

Uitvinder

IBAN-Naam Check

Europese oplossing Wereldwijd netwerk

99,99% uptime

52ms responstijd

Bancaire

veiligheidsstandaarden

Klaar om aan

de slag te gaan?

Meld je aan voor onze IBAN-Naam Check portal en ontvang 10 checks gratis!

Ontdek de voordelen van het integreren van onze API

Deze klanten gingen je voor