Annual Overview 2023

2023 was a year of growth and innovation for SurePay. We have welcomed countless new customers and partners, launched innovative products, run successful radio campaigns, and most importantly, together we were able to prevent a lot of fraud. Take a look at a year full of highlights!

7 Billion Checks performed since 2016!

This year, SurePay performed 1,488,521,279

IBAN-Name Checks

Of this, 10,509,010 were checks for Organisations (the rest for Banks)

We warned 66,060,800 times that IBAN and name did not match

And warned 3,983,790 times that the IBAN number belonged to a closed account

We had an average uptime of 99.98%

And an average response time of 61 milliseconds

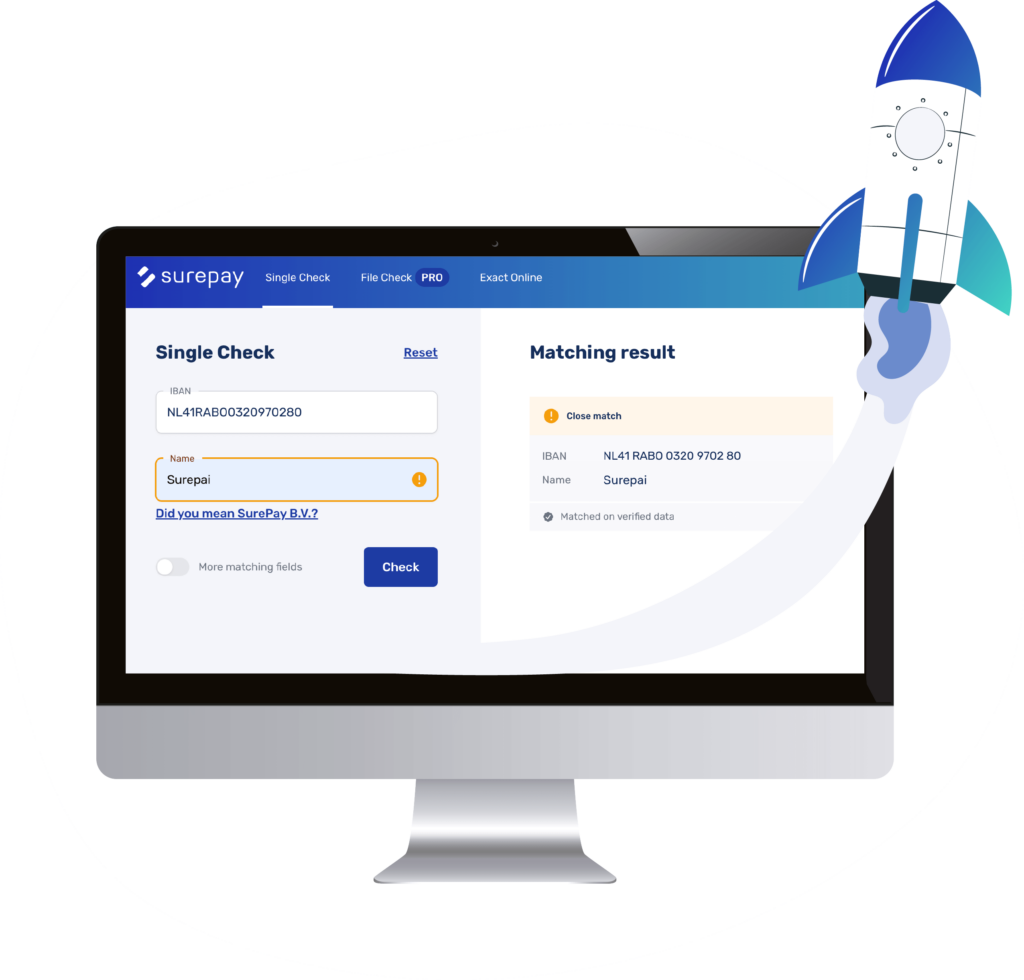

Matching results

-

89,30% Match

The IBAN and name match. Your records are in order. Download the pdf as burden of proof. -

5,70% Close match

If you make a typo in the name, we show the name known to the bank. You can copy the suggested name with just one click. -

5% No match

The IBAN and name do not match. Please contact the person you wanted to pay to and verify the payment information.

In September, we hosted our Banks event

'Borderless Fraud Prevention'

This was an exciting event: exchanging thoughts and experiences with customers, partners and experts on safer international payments. We’ve discussed the impact of the Fraud Risk Indicator, the added value of SWIFT Pre-validation and the changes and opportunities of the European IBAN-Name Check.

SurePay on the radio!

We received many positive reactions and happy new customers through our radio campaigns.

Our campaigns were heard on Radio 1, BNR News Radio and Radio 538, among others.

Customer satisfaction score of 8.5

The feedback and comments of our customers

are very valuable to us. Therefore, as in

previous years, we have conducted our

Customer Satisfaction Survey. We are very

pleased with the results: our customers rate

our IBAN-Name Check solution and our partnership with an 8.5.

We won a Banking Tech Award!

We are very grateful for our victory at the Banking Tech Awards 2023. We won in the category ‘Best PayTech Solution Provider for Banks’ with our Confirmation of Payee (CoP) Portal (in the Netherlands the IBAN-Name Check Portal) designed for PSPs. This achievement is a significant accolade, recognising our role as the innovators behind CoP and commending our dedicated efforts!

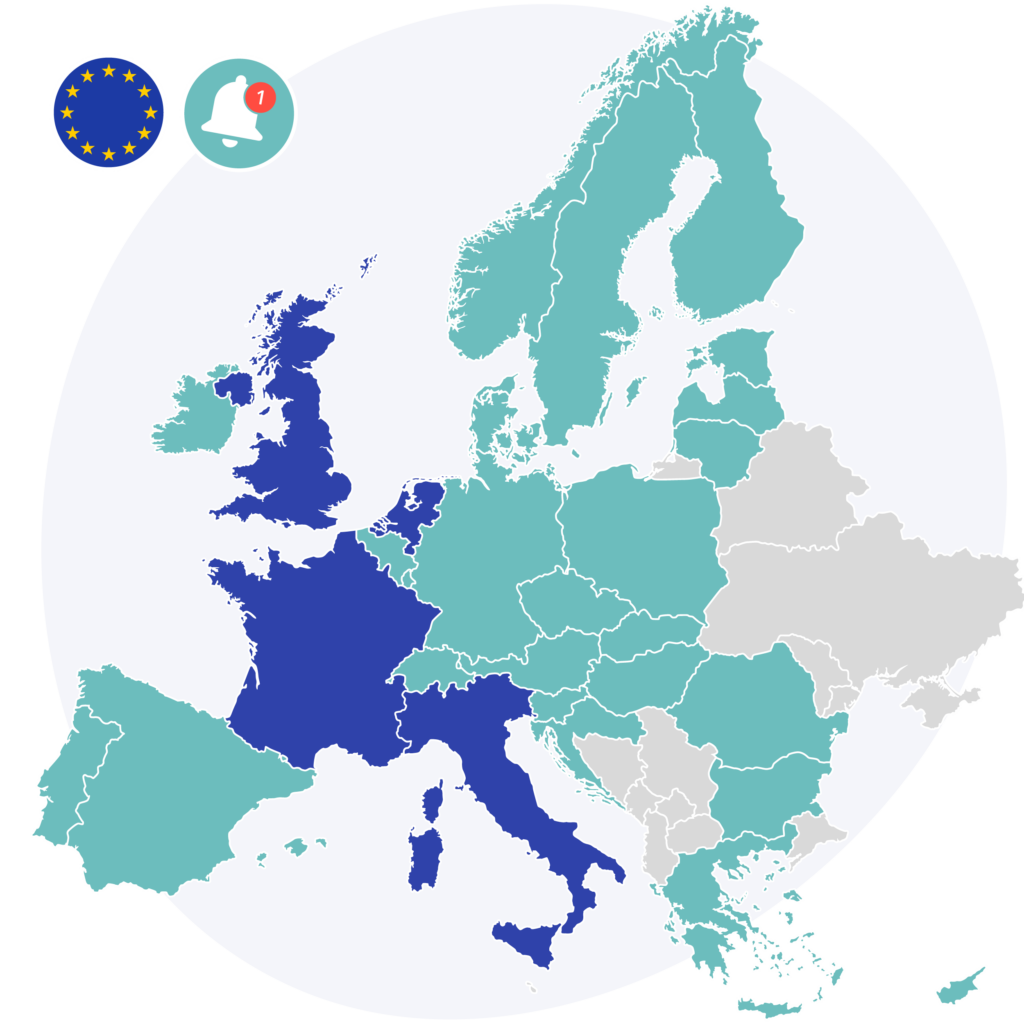

The EU will adopt an IBAN-Name Check solution

The European Commission (EC), the European Parliament (EP) and the Council of the European Union have announced an agreement on the Instant Payments legislation.

As the inventor and pioneer of the IBAN-Name Check solution, SurePay’s experience and technical expertise in rolling out our technology across the EU, puts us in a position to offer a quick, frictionless, and best-in-class implementation for regulated financial institutions.

Launch of IBAN-Name Check Portal...

- Check IBAN and Name directly online

- Prevent fraud and errors when onboarding new customers

- Perform a single check or upload a file

- PDF with matching results as burden of proof for internal and external audits

...And the Developer Portal

The SurePay Developer Portal is the gateway to effectively use the European IBAN-Name Check, and our entire range of added value solutions, and to easily connect yourselves.

David-Jan Janse, CEO SurePay: “Whether you’re a financial institution looking to enhance your payment processes or an organisation seeking to optimise your business operations, the SurePay Developer Portal is here to provide you with the tools and resources you need for success.”

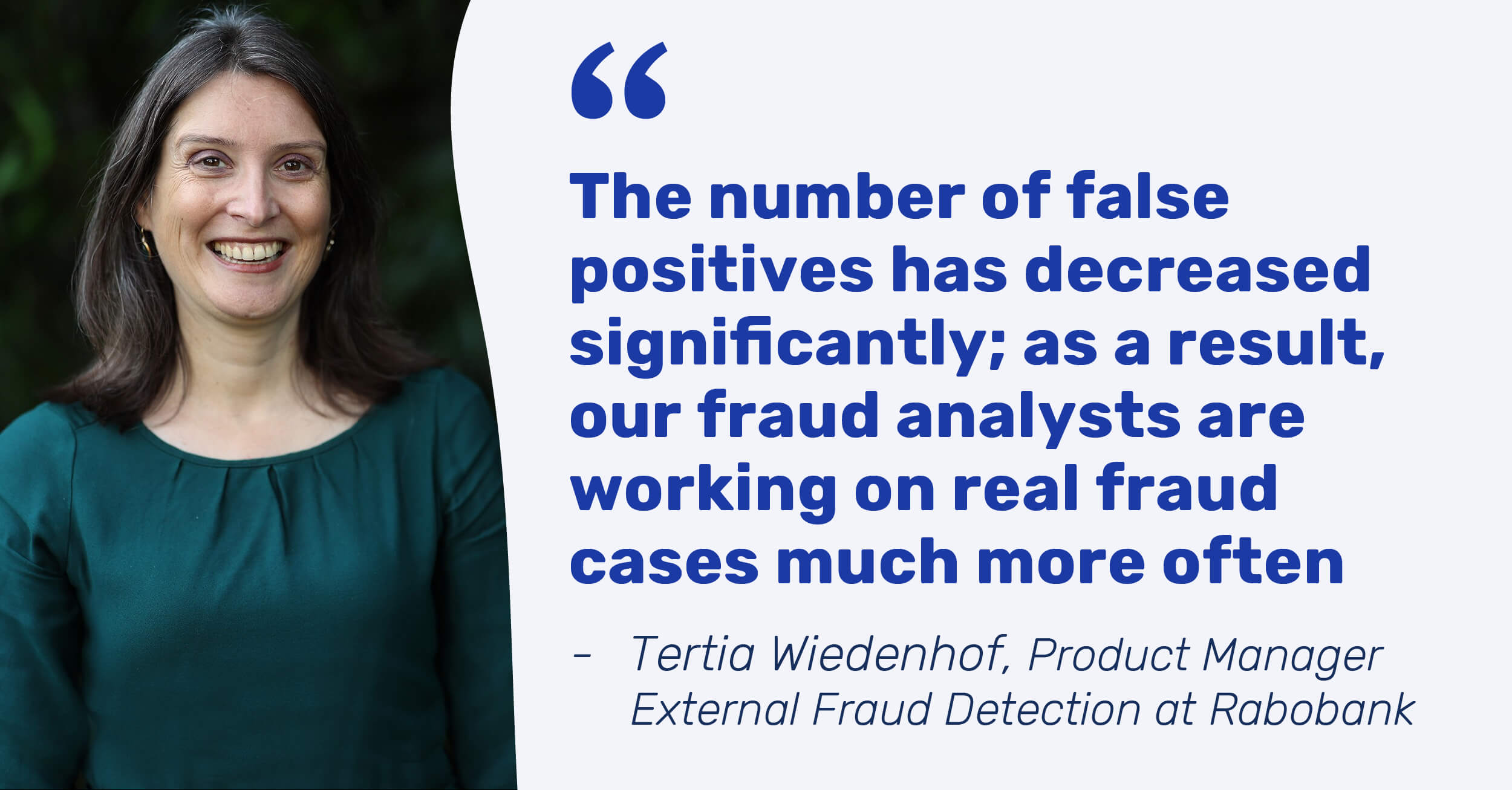

New for Banks: The Fraud Risk Indicator

The Fraud Risk Indicator (FRI) is a solution on top of the IBAN-Name Check: an add-on to the current API. Essentially, the add-on provides additional data points; risk indicators that help the bank determine whether there is an increased or decreased risk of fraud.

Relevant blogs for you

We have written a lot of interesting blogs for you. You can read more about the IBAN-Name Check, Instant Payments legislation, and our solution for various target audiences/organisations.

If you have a topic you would like to know more about, let us know!

Elevating Bank Fraud Prevention with Fraud Risk Indicator

Beyond Rumour: Solving GDPR Challenges in IBAN Name Verification

SurePay IBAN-Name Check portal now available in the Exact App Store

SurePay announces one European IBAN-Name Check

CEO fraud runs rampant, but can be minimised with an IBAN-Name Check

With an IBAN-Name Check, you can also prevent salary payment fraud

SurePay Portal makes checking IBAN and name easier and more accessible